转贷亦或协商利率?

您的房贷经纪人能为您解答

转贷真的是您的最佳选择吗? 一名值得信赖的 房贷经纪人 应当为您全面分析所有可能性——包括帮您与现有银行协商更优惠的利率。

虽然大多数房贷经纪人会按照 Regulatory Guide 273(监管指南 273) (外部链接) 要求以您的利益为先,但潜在矛盾依然存在:留在原银行享受更低利率可能是更明智的选择,而经纪人只有在您转贷时才能获得佣金。

这正是我们在2021年推出 'GPS' 服务准则 的原因。通过最大限度减少利益冲突,我们提供客观公正的转贷建议、以客户满意度为核心的服务标准和高效透明的贷款优化方案——始终将您的利益置于首位。

领先业界的 'GPS' 服务准则

1. General Infomation Only 仅一般信息

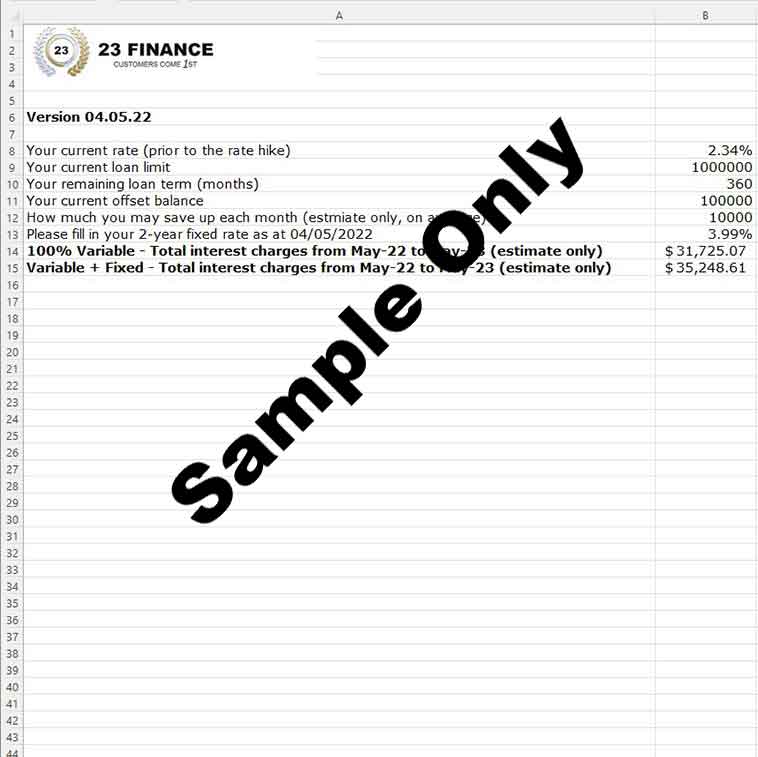

If your goal is to secure a lower interest rate, we only collect essential details—such as your loan type, approximate loan amount, and loan-to-value ratio (LVR). Afterward, we provide a competitive rate comparison, allowing you to confidently negotiate with your current bank.

2. Personal Circumstances 个人情况

If your current bank cannot lower your rate, or if you’re unsatisfied with their counter-offer, and choose to refinance, one of our 房贷经纪人 will contact you to arrange a remote or in-person home loan consultation—allowing us to better understand your personal circumstances.

3. Solution 解决方案

Once we’ve verified your financial situation, we’ll provide a solution tailored to your specific needs, objectives, and financial position. If you’re satisfied with our proposal, our 房贷经纪人 will submit your refinance application on your behalf.

关于23 Finance(23金融)

我们是一家 Sydney-based mortgage broking firm, with extensive experience serving clients in Sydney, Newcastle, Wollongong, and beyond.

我们的 经验丰富的房贷经纪人团队 prioritise our customers’ needs. We uphold our Five Commitments to deliver a personalised, seamless, and hassle-free home loan experience.

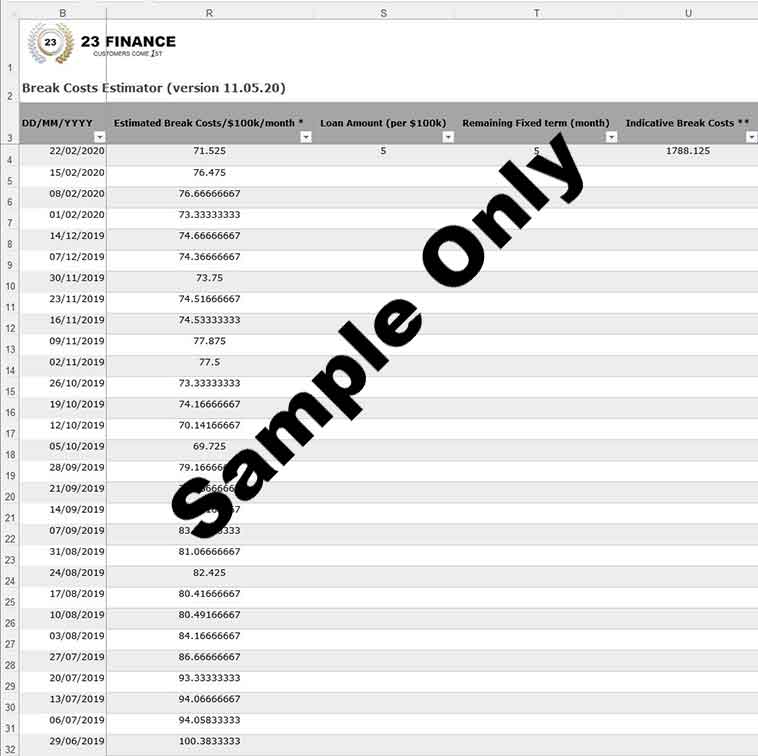

Additionally, once your home loan is approved, you’ll have unlimited access to Resources and Tools prepared by our dedicated support team to help you make well-informed decisions.

公司愿景

We are looking to grow our business sustainably – we would not like to devolve our customer service to standard operating procedures and scripted answers delivered by bots.

We would like to ensure that our customers can always talk to a real person – a person who cares about them.

30+ lenders on our mortgage broking panel

为什么选择我们?

我们的五大承诺:

您是否想了解贷款申请进度,却始终联系不上您的房贷经纪人?我们与众不同!我们提供 多种沟通渠道 ,并承诺在营业时间内1小时内快速响应。

若您有紧急事宜需要下班后处理,欢迎直接联系我们的首席房贷经纪人Alex WANG,电话:0406 635 933。

工作太忙抽不开身?只有午休1小时有空? 别担心!我们提供灵活面谈预约——您只需选择最方便的时间和地点*,我们的房贷经纪人将亲自上门为您服务。

* 仅限悉尼;接受下班后的预约; 请提前预约 。

我们愿意以书面的形式来回答您的任何问题**,以避免事后双方“各执一词”的尴尬(我们也不喜欢这样!)

** 在您的要求下

您的房贷经纪人从您的房贷交割后就杳无音讯?我们更在乎您。我们会每季度与您联系一次,我们还会每年查看您的贷款利率以确保您的利率保持竞争力。

想要尽快转贷?

今天就和我们的房贷专家聊聊吧!

We treat every loan as a time-critical project, applying project management processes to ensure a personalised, seamless, and hassle-free home loan experience with our 房贷经纪人.

- 1. Our mortgage brokers assess your financial situation, requirements, and objectives.

- 2. After verifying your financial details, we work with you to develop a tailored plan.

- 3. With your consent, we’ll submit your home loan application on your behalf.

- 4. We’ll continuously follow up with the lender and keep you updated.

- 5. Our relationship doesn’t end at settlement; we touch base with you quarterly and review your home loan annually.