Refinance or Negotiate?

Your Mortgage Broker Has the Answer

Is refinancing the best option for you? A trusted mortgage broker should help you explore all options—including negotiating a lower rate with your current bank.

While most mortgage brokers act in your best interest as outlined in Regulatory Guide 273 (external link), a conflict can arise: staying with your bank at a lower rate might be the smarter choice, but mortgage brokers only earn upfront commissions if you refinance.

That’s why we introduced our ‘GPS’ approach in 2021. By minimising this conflict, we deliver unbiased refinancing advice, boost customer satisfaction, and improve efficiency—putting your needs first, always.

Industry-leading "GPS" approach

1. General Information Only

If your goal is to secure a lower interest rate, we only collect essential details—such as your loan type, approximate loan amount, and loan-to-value ratio (LVR). Afterward, we provide a competitive rate comparison, allowing you to confidently negotiate with your current bank.

2. Personal Circumstances

If your current bank cannot lower your rate, or if you’re unsatisfied with their counter-offer, and choose to refinance, one of our mortgage brokers will contact you to arrange a remote or in-person home loan consultation—allowing us to better understand your personal circumstances.

3. Solution

Once we’ve verified your financial situation, we’ll provide a solution tailored to your specific needs, objectives, and financial position. If you’re satisfied with our proposal, our mortgage broker will submit your refinance application on your behalf.

About 23 Finance

We are a Sydney-based mortgage broking firm, with extensive experience serving clients in Sydney, Newcastle, Wollongong, and beyond.

Our experienced mortgage brokers prioritise our customers’ needs. We uphold our Five Commitments to deliver a personalised, seamless, and hassle-free home loan experience.

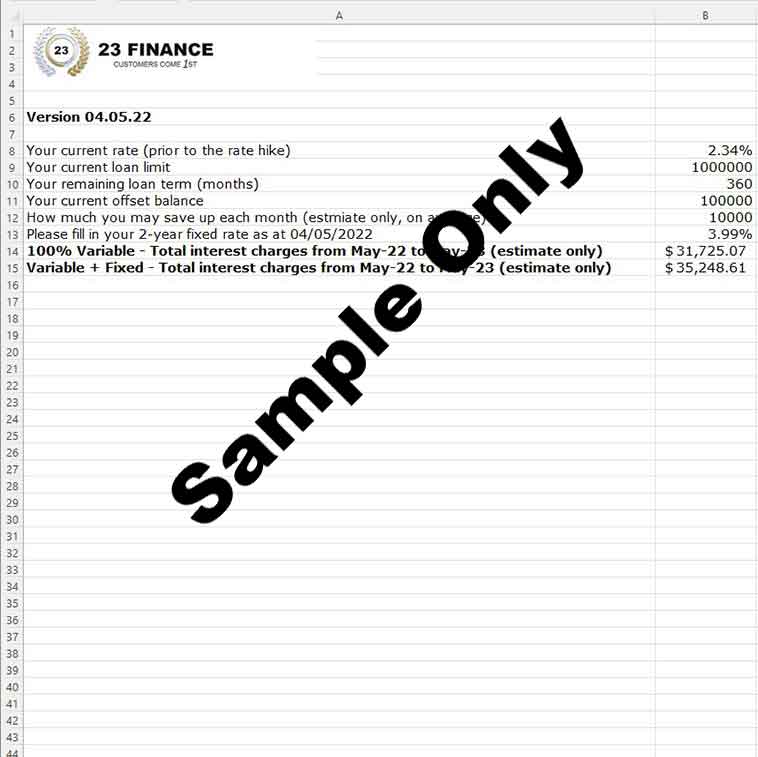

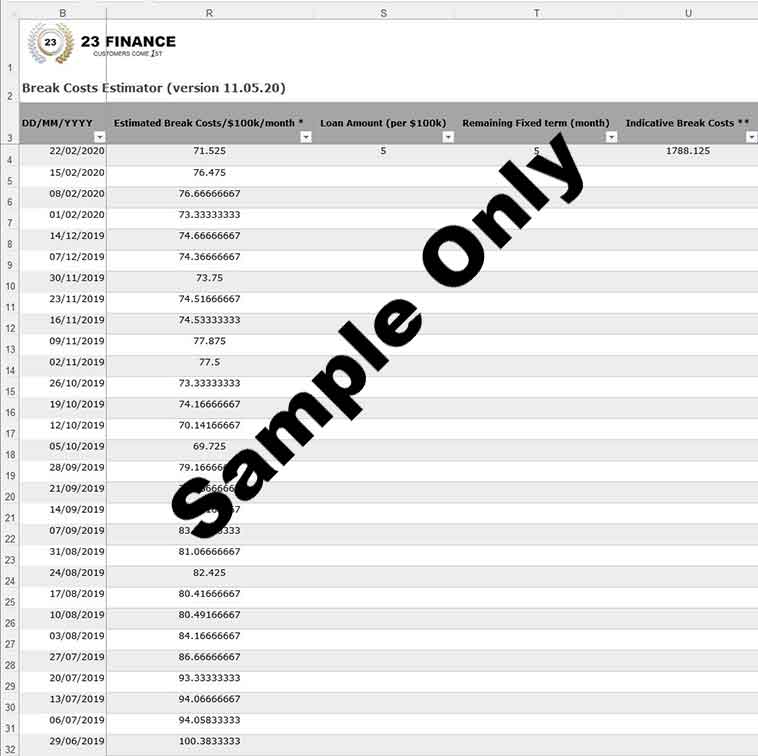

Additionally, once your home loan is approved, you’ll have unlimited access to Resources and Tools prepared by our dedicated support team to help you make well-informed decisions.

Company Vision

We are looking to grow our business sustainably – we would not like to devolve our customer service to standard operating procedures and scripted answers delivered by bots.

We would like to ensure that our customers can always talk to a real person – a person who cares about them.

30+ lenders on our mortgage broking panel

Why Choose Us?

Our FIVE commitments to you:

Would like to have an update on your application, but can never get hold of your mortgage broker? We are different! We have multiple channels for you to reach out to us, and we commit to respond you within one hour during business hours.

For any urgent after-hours matter, please feel free to contact our principal mortgage broker Alex WANG on 0406 635 933

Would like to meet us in person, but too busy at work? Only available during your 1-hour lunch break? No worries! We have flexible appointment options available for you – you can choose a time and place that suits you best*, we will come to see you.

* Sydney Metroplitan area only; after hours appointment available; pre-booking required.

We are more than happy to answer your queries in writing**, to avoid any ‘he said, she said’ situation arise in the future (we don’t like it, too)

** upon your request

Have not heard anything from your mortgage broker since the settlement? We treat you differently. We touch base with you on a quarterly basis, and we review your home loan(s) annually to ensure that your rate stays competitive.

We offer value-added complimentary member services to our customers. We will set up your full membership and email you your personal login once your loan is approved (incl. pre-approval). In addition, TWO additional 3-month trial membership can be set up upon your request for you to share with your family and friends. Our member services include but not limited to:

1. special offers from our external business partners (quote your membership number; at the sole discretion of our external business partners)

2. unlimited free customised property reports***

3. unlimited access to the resources and tools prepared by our support team

*** full membership required

Ready to Refinance?

Speak with one of our experienced mortgage brokers today!

We treat every loan as a time-critical project, applying project management processes to ensure a personalised, seamless, and hassle-free home loan experience with our mortgage brokers.

- 1. Our mortgage brokers assess your financial situation, requirements, and objectives.

- 2. After verifying your financial details, we work with you to develop a tailored plan.

- 3. With your consent, we’ll submit your home loan application on your behalf.

- 4. We’ll continuously follow up with the lender and keep you updated.

- 5. Our relationship doesn’t end at settlement; we touch base with you quarterly and review your home loan annually.